CAANZ and Mark Rice – Regulatory Failure and Professional Retaliation

As a member of the accounting profession, I was entitled to expect that my professional regulator, Chartered Accountants Australia and New Zealand (CAANZ), would act independently, fairly, and in the public interest. Instead, my experience with CAANZ—particularly through Mark Rice—has been characterised by dismissal, obstruction, professional attack, and apparent complicity in the very misconduct I reported.

Ignored and Dismissed

From the outset, CAANZ refused to meaningfully engage with the substance of my complaints. Detailed evidence of fraud, conflicted audits, professional misconduct, and whistleblower retaliation was repeatedly provided. Rather than investigating, CAANZ:

Ignored key evidence and regulator correspondence;

Issued cursory or template responses;

Declined to exercise its disciplinary powers;

Reframed serious complaints as “membership issues” to avoid scrutiny.

This occurred despite the matters involving systemic failures by senior accountants, including individuals holding leadership roles within firms regulated by CAANZ.

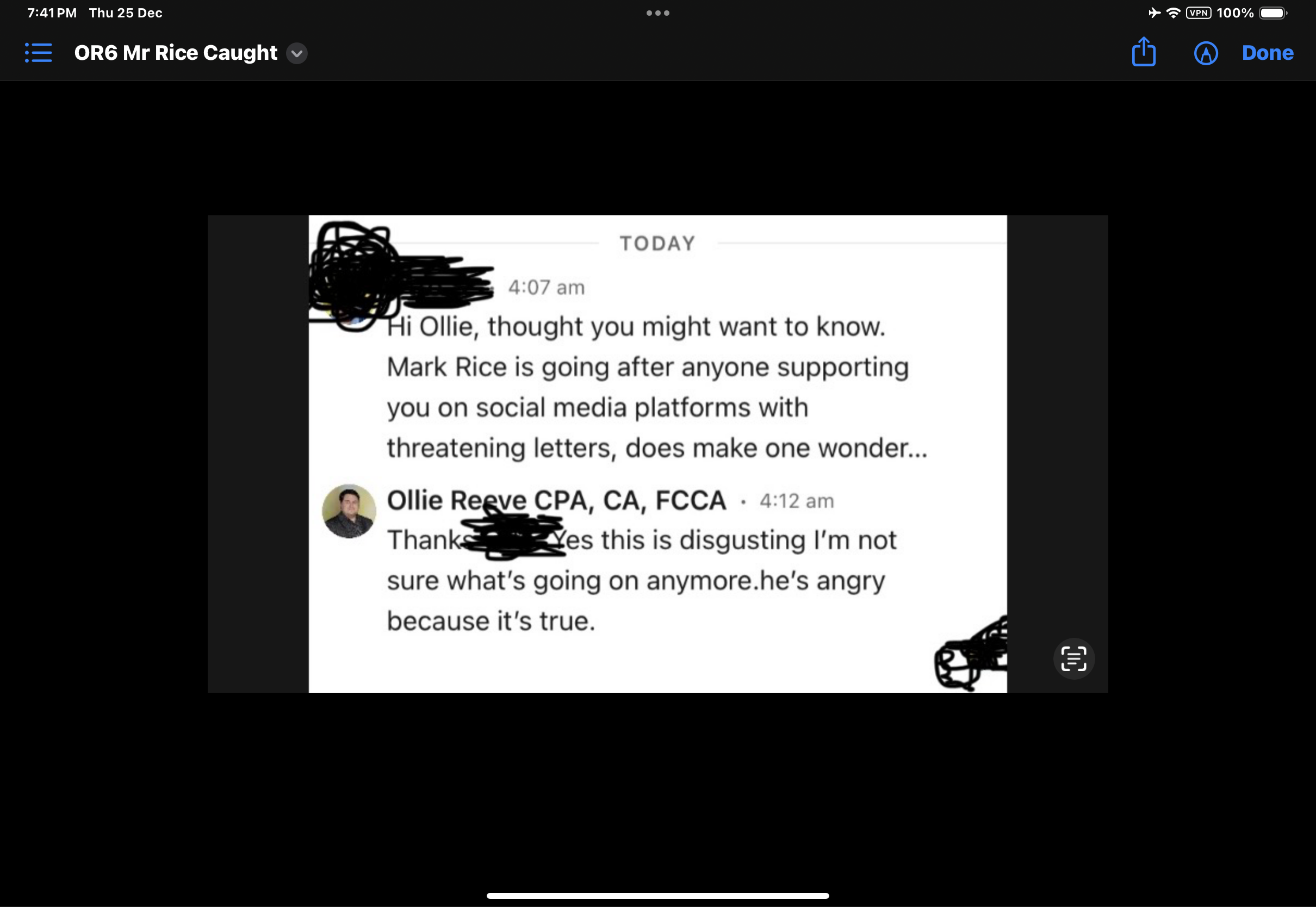

Professional Attacks and Retaliation

Rather than acting as a neutral regulator, CAANZ—under the direction or involvement of Mark Rice—engaged in conduct that actively harmed my professional standing:

My credibility was questioned without evidence;

Legitimate whistleblower activity was mischaracterised as misconduct;

Procedural processes were weaponised to delay, frustrate, and exhaust;

I was subjected to condescending, dismissive, and at times insulting communications.

These actions compounded the professional and financial harm already caused by retaliation elsewhere.

Conflicts and Involvement in the Fraud

Evidence now demonstrates that CAANZ and senior personnel were not merely passive bystanders. Mark Rice and others were:

Aware of the underlying fraud and conflicts well before key decisions were made;

Connected to firms and individuals implicated in the misconduct;

Involved in decisions that protected those firms from disciplinary consequences;

Instrumental in suppressing scrutiny rather than facilitating it.

As a result, CAANZ functioned not as a regulator, but as a protective shield for powerful members, prioritising institutional reputation over professional integrity and public protection.

Why This Is Dangerous

CAANZ occupies a critical gatekeeping role. When it refuses to act on credible evidence of fraud—and instead targets the whistleblower—it sends a clear message that:

Professional misconduct will be tolerated if committed by the “right” people;

Whistleblowers will be isolated and punished;

The public cannot rely on self-regulation to protect them from harm.

This failure is not merely administrative. It represents a collapse of professional oversight, with real consequences for investors, employees, and public confidence in the accounting profession.

This website documents CAANZ’s conduct to ensure the public record reflects how a professional regulator abandoned its duties and became part of the problem it was meant to prevent.