Dr Nigel Purves – Prior Misconduct, Regulatory Sanctions, and Ongoing Risk

Nigel Purves is a former accounting professional whose history raises serious concerns for investors, regulators, and the public. His involvement across multiple companies connected to the Walter Doyle network follows a pattern already documented elsewhere on this website: individuals with prior misconduct histories re-emerging in positions of influence despite regulatory sanctions.

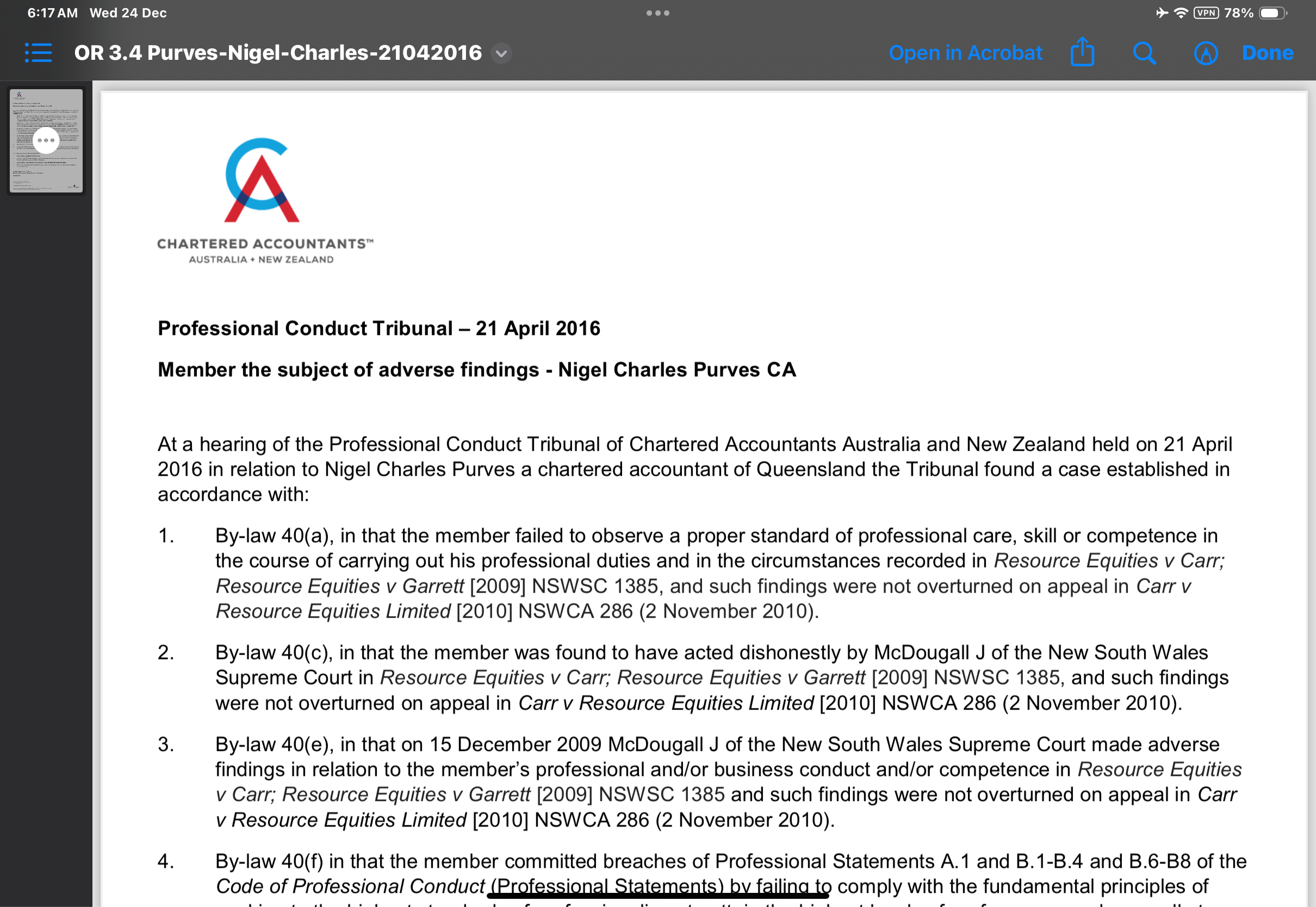

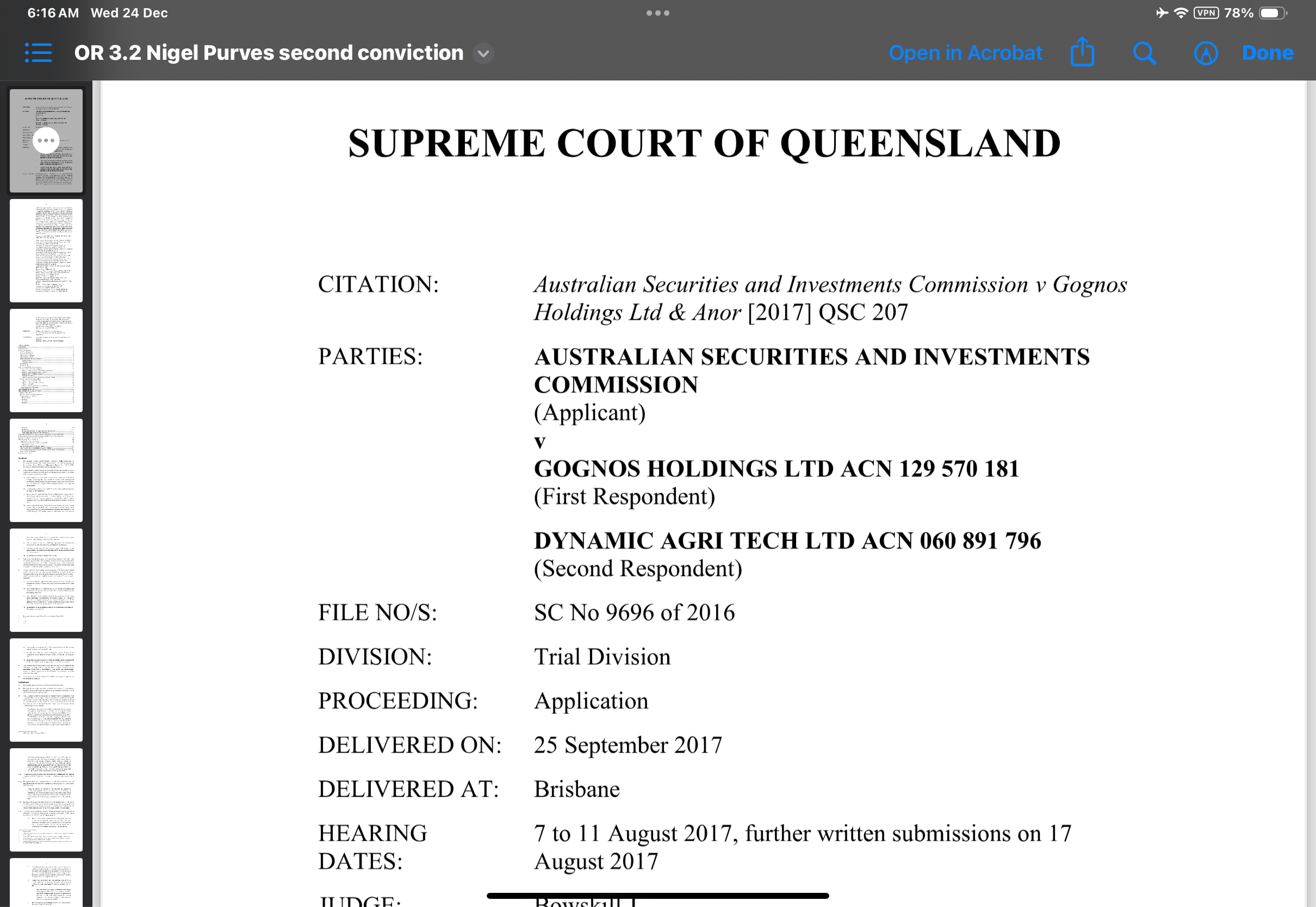

Prior Findings and Loss of Professional Standing

Dr Purves has previously been found by courts and professional bodies to have engaged in serious misconduct, including fraud-related behaviour and the manipulation of evidence. As a result of these findings and disciplinary processes, he lost his professional standing and memberships, including:

These sanctions reflect determinations that his conduct fell well below the standards required of trusted financial professionals. The loss of accreditation is a matter of public and regulatory record.

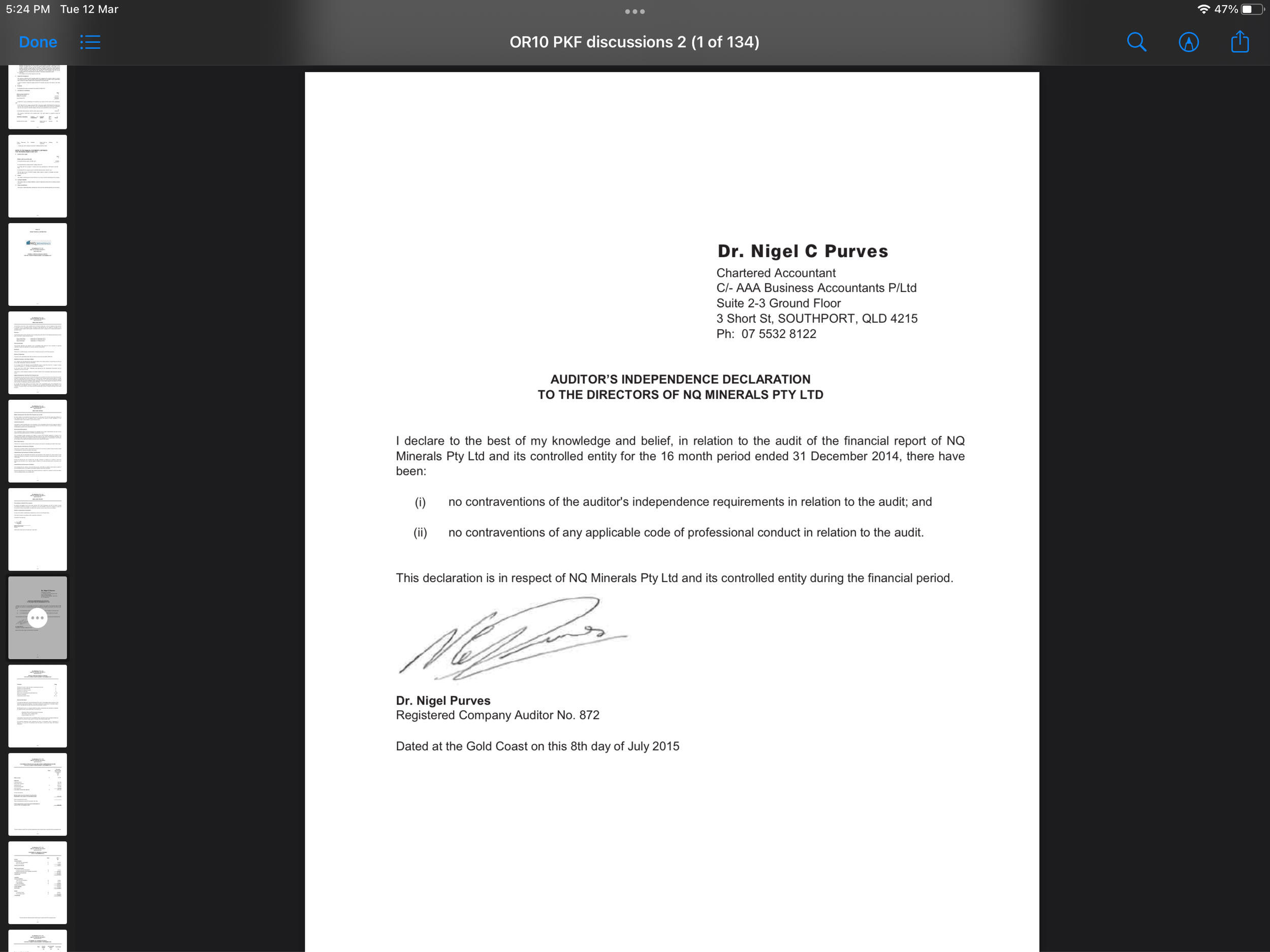

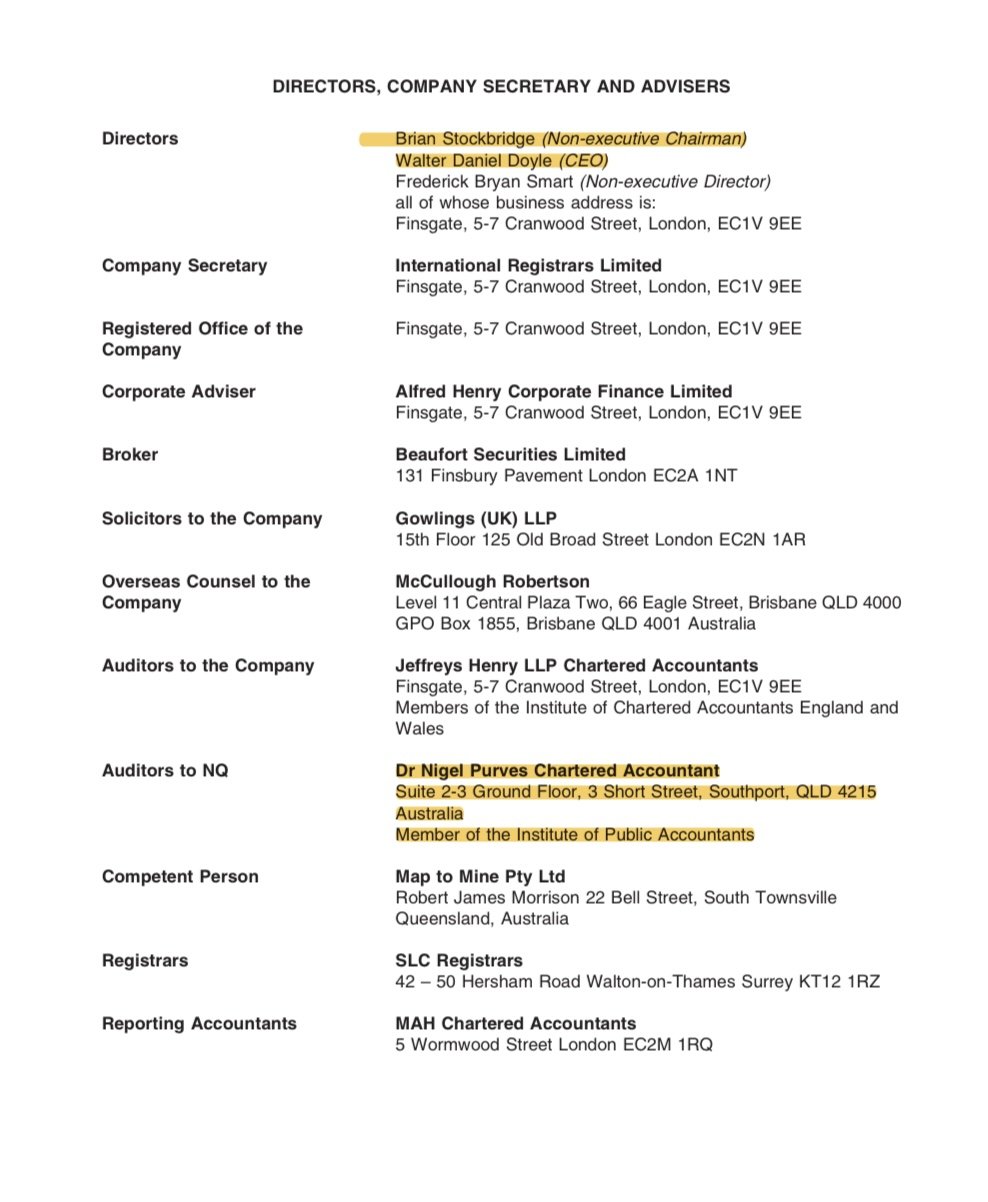

NQ Minerals PLC – Unauthorised Audit Sign-Offs

Despite these sanctions, Dr Purves later appeared in connection with NQ Minerals PLC, where he is alleged to have acted as an unauthorised auditor. Evidence indicates that he unlawfully signed audit reports that were relied upon to support NQ Minerals’ public listing and ongoing market disclosures.

These audit sign-offs occurred despite Dr Purves not being authorised or permitted to act in that capacity. The effect was to provide a false appearance of compliance and credibility to financial statements that later proved to be materially misleading, contributing to significant investor harm.

Re-Emergence Through Intergroup Mining

More recently, Dr Purves has re-emerged publicly as a representative of Intergroup Mining Limited, including appearing at investment events. This involvement is notable given his disciplinary history and the serious allegations surrounding Intergroup Mining’s fundraising, governance, and related-party transactions.

His presence at investor events raises questions about disclosure, suitability, and due diligence, particularly where potential investors are unlikely to be informed of his prior sanctions and findings.

ChemX Materials – Directorship and Ownership Concerns

Dr Purves has also recently obtained ownership and directorship interests in ChemX Materials, a financially distressed company listed on the ASX. This development is of particular concern because:

Dr Purves is alleged to be a banned or disqualified person under relevant regulatory frameworks;

His appointment and control raise questions about compliance with director eligibility requirements;

The transaction is alleged to form part of an attempt to “wash” or re-route the Intergroup Mining fraud through a listed entity, obscuring provenance and accountability.

These issues have significant implications for market integrity and investor protection.

Why This Matters

The continued re-appearance of individuals with documented histories of serious misconduct in capital markets is not accidental. It reflects systemic regulatory failure, where enforcement gaps allow disqualified or sanctioned actors to re-enter positions of influence via new corporate vehicles.

When unauthorised auditors sign off on public filings, when banned individuals obtain control of listed entities, and when regulators fail to intervene, the risk is borne by ordinary investors and the public.

Why This Is Documented Here

Dr Purves’ conduct is documented on this website because it illustrates how prior findings and sanctions are being ignored, enabling the repetition of harm across multiple companies. Transparency is essential where regulatory systems fail to prevent re-offending.

This is not about past mistakes. It is about ongoing risk, unresolved accountability, and the protection of future investors.